September 26, 2012 by namawinelake

Yesterday, the Irish pension industry held a key conference ? the Irish Life pensions conference ? and you won?t be surprised to learn that it is manoeuvring in advance of the Budget 2013 announcements in December to avoid further measures which will eat into its business ? nothing surprising in that, and in fact the industry might be praised for getting its tuppence worth in early. You can expect lots of similar sabre-rattling and batons-on-shields in the next two months in the run-up to the actual budget announcement. However, yesterday distinguished itself because the boss at the Department of Finance delivered a speech and Charlie Weston at the Independent today reports ?Secretary general of the Department of Finance John Moran told the conference the State had signed up to delivering a further ?900m in savings from pensions in the period up to 2012, ?including a move to standard rate tax relief on pension contributions over that time?.?

This is new.

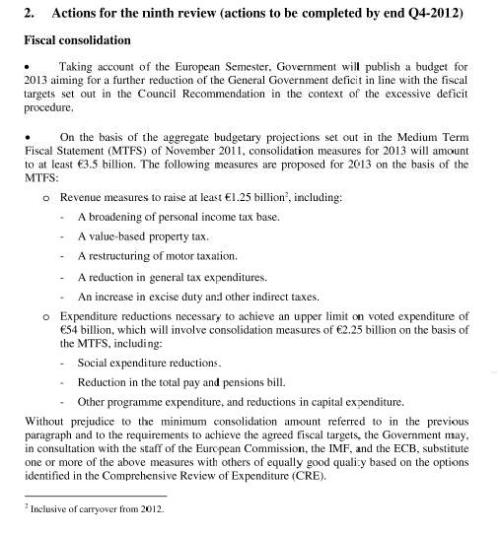

The Memorandum of Understanding with the bailout Troika makes no reference to pensions at all, in the context of Budget 2013 ? see below. So if the Independent?s reporting is correct, then it appears to be a major piece of news that pensions will yield such results in the forthcoming budget.

Last week in the Dail, the Sinn Fein finance spokesperson Pearse Doherty asked the Minister for Finance Michael Noonan to estimate the effect of reducing the allowance rate on pension contributions to the lower rate of tax, 20% and also reducing the earnings cap to ?75,000. The response was that it would generate ?540m per annum though there are caveats. This is the full exchange.

Deputy Pearse Doherty: To ask the Minister for Finance the earnings cap for pensions contributions; and the estimated return to the Exchequer if the earnings cap was reduced to ?75,000 and pensions tax reliefs then granted at 20%.

Minister for Finance, Michael Noonan: I assume that the Deputy is referring to the current annual earnings cap of ?115,000 which operates to limit the level of tax-relieved personal pension contributions in any one year. The annual earnings cap acts, in conjunction with age-related percentage limits of annual earnings, to put a ceiling on the annual amount of tax relief an individual taxpayer can obtain on pension contributions.

A breakdown of the cost of tax relief on employee contributions to occupational pension schemes is not available by income tax rate, as tax returns by employers to the Revenue Commissioners of employee contributions to such schemes are aggregated at employer level. An historical breakdown is available by tax rate of the tax relief claimed on contributions to personal pension plans ? Retirement Annuity Contracts (RACs) and Personal Retirement Savings Accounts (PRSAs) ? by the self-employed and others, to the extent that the contributions have been included in the personal tax returns of those taxpayers. There is, therefore, only a limited statistical basis for providing definitive figures.

However, by making certain assumptions about the available information, the Revenue Commissioners inform me that the combined estimated full year yield to the Exchequer from reducing the current annual earnings cap of ?115,000 to ?75,000 and confining tax relief to the standard rate of 20% in respect of individual contributions to occupational pension schemes, RACs and PRSAs would be about ?540 million.

Source: http://namawinelake.wordpress.com/2012/09/26/is-this-the-first-authentic-budget-2013-leak/

nba all star reserves rock center christine christine will ferrell double fine adventure turbo tax

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.